If you want to see how good Alexa is at answering people's questions you should sign on to Alexa Answers and see the questions Alexa cannot answer. This site has gamified helping Alexa answer these questions. I spent a week doing this and figured out a pretty good work flow to stay in the top 10 of the leader board.

The winning strategy is to use Google. You copy the question in to Google and paste the answer Google back in to the Alexa Answers website for it to played back to the person who asked it. The clever thing is that since it is impossible to legally web-scrape Google.com at a commercially viable rate, Amazon have found a way of harnessing the power of Google without a) having to pay, b) violating Google.com's TOS, and c) getting caught stealing Google's IP.

After doing this for a week, the interesting thing to note is why Alexa could not answer these questions. Most of them are interpretation errors. Alexa misheard the question (e..g connor virus, coronda virus, instead of coronavirus). The remainder of the errors are because the question assumes Alexa's knowledge of the context (e.g. Is fgtv dead? - he's a youtube star) and without the subject of the question being a known entity in Alexa's knowledge graph, the results are ambiguous. Rather than be wrong, Alexa declines to answer.

Obviously this is where the amazing pattern matching abilities of the human brain come in. We can look at the subject of the question and the results and choose the most probable correct answer. Amazon can then augment Alexa's knowledge graph using these results. This is probably in violation of Google's IP if Amazon intentionally set out to do this.

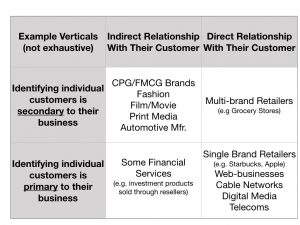

Having a human being perform the hard task in a learning loop is something that we have also employed in building our platform. Knowledge Leaps can take behavioral data and tease out price sensitivity signals, using purchase data, as well as semantic signals in survey data.