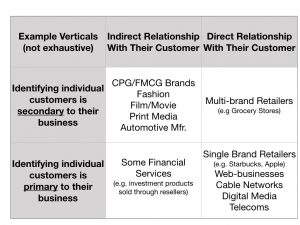

I think a lot about data and about different types of data and who is using it. I produced this table that classifies the relationship with data for firms in different verticals. It also shows the relationship between the use of survey data and the use of behavioral data to understand the performance of their business. Those firms that haven't traditionally required identifying a customer as an individual have had a greater reliance on survey data to understand their customer the those firms where you require an account to buy from them.

All firms use $ sales and profit to measure their performance, but along the way firms need proxy measures - these are either going to come from behavioral data (clicks, foot traffic, etc) or from proxy measures (customer satisfaction gather in surveys).

As more businesses have become customer-data-centric if not fully customer-centric, there has been an increasingly reliance on customer behavioral data rather than survey data to measure performance.

Over the past decade this has been driven by many firms moving from the top-left quadrant to the bottom-right quadrant, notable examples are Apple and many video game developers and publishers.

I wonder if there is a performance inflection point? For example is there a threshold value for the proportion of your customer base that you have a relationship with, above business performance weakens, especially in markets where there isn't a monopoly and near-monopoly. Since customers are always churning, customer acquisition is key to driving sales growth. However, having a known pool of customers (current and lapsed) could breed a sense of complacency in firms. Contrast that with firms who do not have a direct relationship with their customers, this induces a certain degree of paranoia that puts customer retention and acquisition at the top of their agenda.